Diesen Inhalt auf deutsch übersetzen und umschreiben. Die Länge des Beitrags beibehalten. Unterteile den Beitrag in mehrere Absätze mit h2 und h3 Zwischenüberschriften. Beachte den SEO Aspekt und schreibe h2 und h3 Überschriften..

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram and X

What a fucking week. If you were a numpty and didn’t fly into Singapore for Token2049 last week, I pray for your soul. Over 20,000 righteous acolytes praised the Lord in whatever way they deemed appropriate. I have been to almost every Formula 1 in Singapore since the night race began, and I have never seen the city so alive.

Token2049 has doubled in attendance year-over-year. I heard rumours that some little-known projects paid upwards of $650,000 to speak on some of the smaller stages.

The parties were packed. Marquee is a club that fits a few thousand people. Take a gander at this over three-hour-long queue to get into this event. A different crypto project or company booked the club out every night of the week. The booking fee for Marquee, not including any alcohol, is $200,000.

There were all types of events for all types of folks. Iggy Azalea flew in a gaggle of strippers from LA to create a pop-up “experience.” Who would have thought strippers would understand how to operate in volatile markets? 😉

Even this clown Su Zhu (aka the Randall of Crypto) couldn’t resist attempting to make it rain. Randall, why you lookin’ so uncomfortable in this video? Losing money is your specialty. When you finally pony up your assets to the BVI bankruptcy court and settle the lawsuit, I will happily host you at Magic City and show you how it’s done.

I’m considering having Branson Cognac and Le Chemin du Roi sponsor my next party… in the words of 50 Cent:

Every hotel was full, and the same went for any half-decent restaurant. When all is tallied for 2024, I suspect we’ll find that the crypto crowd brought more business to airlines, hotels, restaurants, conference venues, and nightclubs than any other event in Singapore’s history.

Thankfully, Singapore attempts to be as geopolitically neutral as possible. That means that as long as you believed in Satoshi, you could, for the most part, come and rejoice with your brothers and sisters in the Lord.

The energy and enthusiasm of crypto folks stand in stark contrast to the staid and boring comportment of TradFi conference-goers. The Milken Institute also puts on a conference during the same week. If you walk around the Four Seasons, where the conference is held, every man and woman looks the same in their bland business casual/formal attire. And it is on purpose that the TradFi costume and behaviour are placid and never changing. They want the population to think “nothing to see here” while they steal the dignity of humanity with the inflation that their institutions hoist upon the world. Volatility is their enemy because when things start moving, the plebes get to peer into the looking glass and witness the true degeneracy of their masters.

Today, we’re covering the volatility of crypto and its absence in TradFi. I want to discuss how the elites print money to create a placid economic surface. And, I want to talk through how Bitcoin is the release valve for the fiat printed in an attempt to suppress volatility to unnatural levels. But first, I want to illustrate a salient point that short-term macroeconomic predictions don’t matter by stepping through my track record from November 2023 until the present.

50/50 At Best

Many readers and crypto X keyboard warriors routinely lambast me for getting everything wrong. How have I done on my major calls over the past year?

November 2023:

I wrote an essay entitled “Bad Gurl. “ In this piece, I predicted that US Treasury Secretary Bad Gurl Yellen would issue more Treasury bills (T-bills) to drain funds from the US Federal Reserve’s (Fed) Reverse Repo Program (RRP). A falling RRP would inject liquidity into the system and cause risk assets to rise. I believed that the market would soften by March 2024, when the Bank Term Funding Program (BTFP) was set to expire.

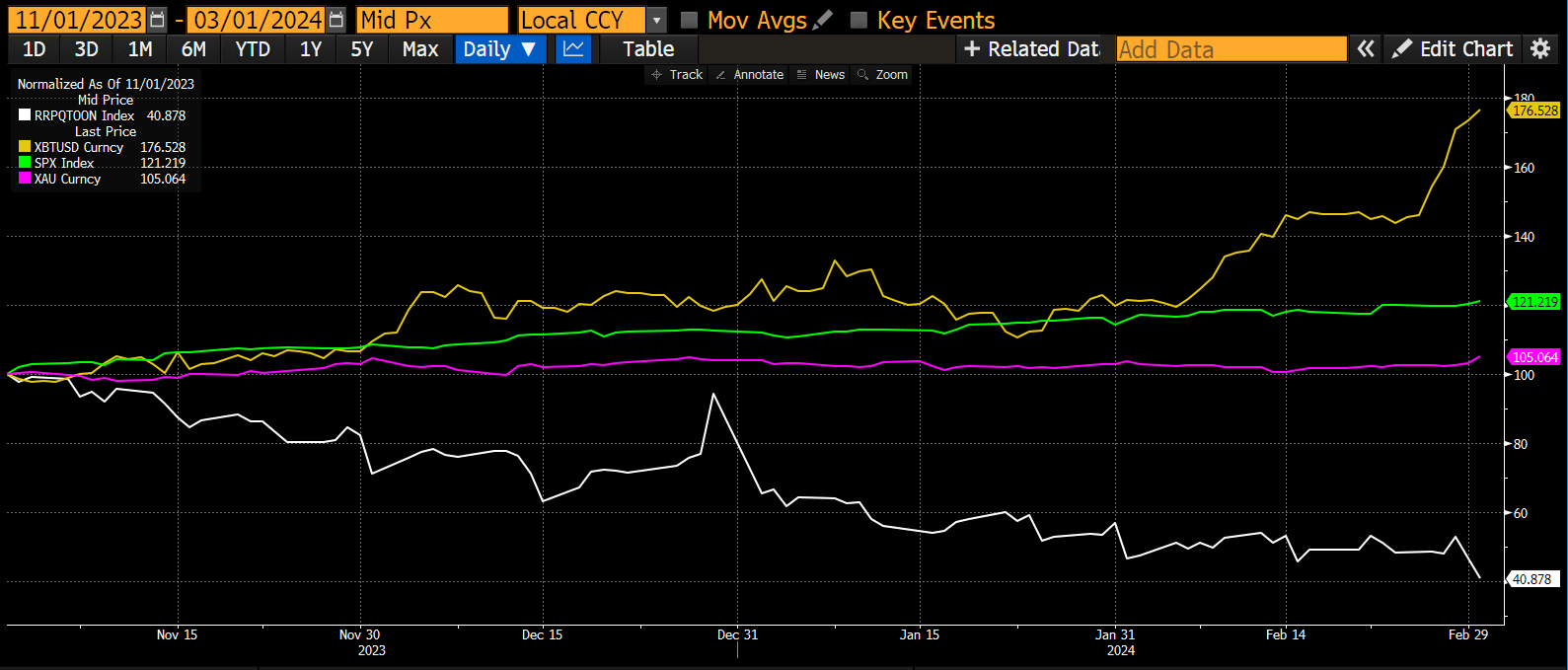

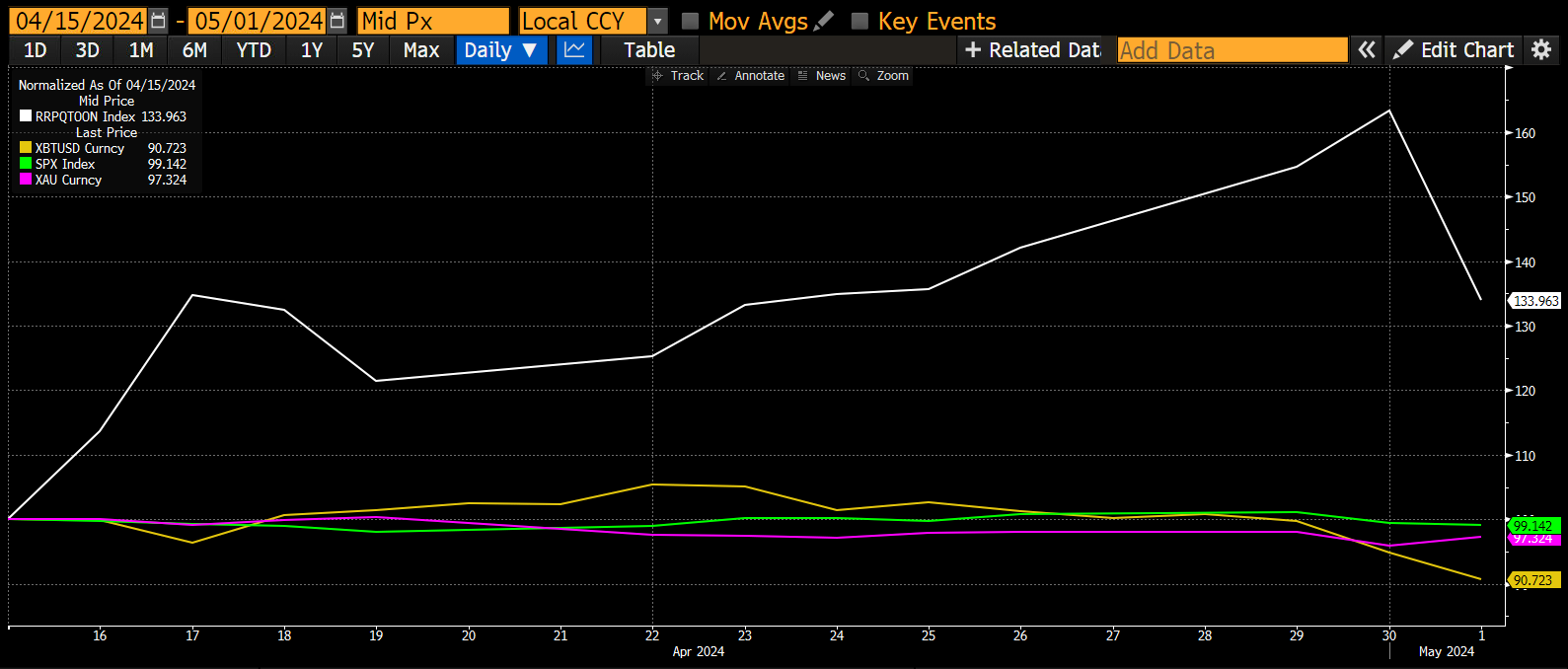

From November 2023 to March 2024, the RRP (white) fell 59%, Bitcoin (gold) rose 77%, the S&P 500 Index (green) rose 21%, and gold (magenta) rose 5%. Each data set is indexed at 100.

+1 in the win column.

I added more crypto risk once I read through the contents of the US Treasury’s Quarterly Refunding Announcement (QRA). In hindsight, this was a great decision.

March 2024:

In my essay “Yellen or Talkin,’” I postulated that the BTFP would not be renewed due to its apparent inflationary aspects. I did not believe that allowing banks to access the discount window would be enough to avert another non-Too Big To Fail (TBTF) US banking crisis.

The expiry of the BTFP did not materially affect markets.

+1 in the loss column.

I lost money on a small position in Bitcoin puts.

April 2024:

In my essay “Heatwave,” I predicted that tax season in the US would cause crypto prices to dip as dollar liquidity was removed from the system. Specifically, I said I would hold off on adding any additional crypto risk between April 15th and May 1st.

From April 15th to May 1st, the RRP (white) rose 33%, Bitcoin (gold) fell 9%, the S&P 500 Index (green) fell 1%, and gold (magenta) fell 3%. Each data set is indexed at 100.

+1 in the win column.

May 2024:

As I headed off for the northern hemispheric summer holidays, I published “Mayday” based on several macroeconomic factors. I had these predictions:

- Did Bitcoin hit a local low at around $58,600 earlier this week? Yes

- What is your price prediction? A rally to above $60,000 and then range-bound price action between $60,000 and $70,000 until August.

Bitcoin hit a low of around $54,000 on August 5th due to a bout of dollar-yen carry trade unwind. I was off by 8%.

+1 in the loss column.

Bitcoin’s range during that period was ~$54,000 to $71,000.

+1 in the loss column.

I did add a bit of shitcoin risk over the summer during periods of weakness. Some of the coins I bought are trading lower than where I purchased them, and some are higher.

June & July 2024:

When Japan’s fifth largest bank owned up to its massive losses on foreign bonds, I wrote an essay about the importance of the dollar-yen exchange rate entitled “Shikata Ga Nai.” I predicted that the BOJ would not raise rates as it would imperil the banking system. That proved to be a naive assumption. On July 31st, the BOJ raised rates by 0.15% and kicked off a vicious dollar-yen carry trade unwind. I followed up on the dollar-yen carry trade unwind mechanics with my essay “Spirited Away.”

While the dollar-yen proved to be the most important macroeconomic variable, I got the BOJ call wrong. The policy response was not as I predicted. Instead of dollars being supplied by central bank swap lines, the BOJ assured the market it would not raise rates or adjust its money printing policies if it would cause heightened market volatility.

+1 in the loss column.

August 2024:

Two major events occurred this month: the US Treasury’s release of the 3Q24 QRA and the Powell Payrolls Pivot at Jackson Hole.

I predicted that Bad Gurl Yellen’s renewed net issuance of T-bills would provide dollar liquidity to the market. But after the Powell Pivot, where he confirmed a September rate cut, these two forces acted in opposition to each other. At first, I believed a net issuance of T-bills would add liquidity as it would drain the RRP to zero, but then T-bill yields dropped below that of the RRP, and I forecasted the RPP would rise and drain liquidity.

I did not expect Powell to cut rates before the election and risk an explosion of inflation right as voters cast their ballots.

+1 in the loss column.

The RRP balance increased directly after Jackson Hole declined, and is back on an upward trajectory. Therefore, I still believe this will act as a minor liquidity drag as T-bill yields continue to fall, as the market expects more cuts at the Fed’s November meeting.

No result; it’s too soon to tell if I’m right or wrong.

September 2024:

As I exited the Patagonian mountains, I penned an essay, “Boom Times … Delayed,” and went on the speaking circuit at Korea Blockchain Week and Singapore Token2049 with a prediction of a negative market reaction if the Fed cut rates. Specifically, I pointed out that a narrowing dollar-yen interest rate differential would cause the yen to strengthen further and reignite the carry trade unwind. This would cause global markets, including crypto to fall, which ultimately would necessitate greater money printing to put Humpty Dumpty back together again.

The Fed cut, and the BOJ held, which narrowed the interest rate differential; however, the yen weakened against the dollar, and risk markets performed well.

+1 in the loss column.

The Results:

2 Correct Predictions

6 Wrong Predictions

So the Batting Average = .250. That’s pretty shit to the common man, but as the great Hank Aaron said, “My motto was always to keep swinging. Whether I was in a slump or feeling badly or having trouble off the field, the only thing to do was keep swinging.” Aaron’s lifetime batting average was .305, and he is considered one of the best baseball players of all time.

And regardless of the strikeouts, I am still making money.

Why?

The Mega Assumption

The exercise I’m engaging in while writing these macro essays is attempting to forecast the specific events that will lead to a policy response by our corrupt masters. We know that they cannot handle any sort of volatility in financial markets because of how overleveraged the entire post-1971 Bretton Woods trade and financial system is. We, and by that, I mean TradFi muppets and Satoshi disciples, all agree that when shit hits the fan, the Brrrr button shall be pressed. This is always the policy response.

If I can predict the trigger a priori, my ego is burnished, and maybe I’ll clip a few extra percentage points of profit by being a tad early. But as long as my portfolio is geared to benefit if printed fiat is supplied to suppress the natural volatility of human civilization, it doesn’t matter if I get every single event-driven prediction wrong as long as the policy response is as expected.

I will show you two charts to help you understand the gargantuan amount of fiat money required to suppress volatility at historic lows.

Volatility

Starting in the late 19th century, the elites running global governments made a deal with the plebes. If the plebes handed over more and more of their freedoms, the “smart” people running the state would create a calm universe by keeping entropy, chaos, and volatility at bay. As the decades progressed and the role of government became greater in every citizen’s life, it became extremely expensive to maintain a veneer of ever-increasing order in a world becoming more complex as our knowledge about our universe increased.

Previously, a few men wrote books that were the definitive source of truth about how the universe operated. They killed or shunned any man that practised science. But as we removed the shackles of organised religion and thought critically about the universe we inhabit, we realised we know nothing and things are much more complex than you would otherwise believe if you just read the Bible, Torah, or Koran, for example. It is then understandable that humans flocked to politicians (mostly men, a few women) who replaced priests, rabbis, and imams (always men, never women) in offering a prescriptive way to live that promises safety and a rubric to understand how the universe operates. But whenever volatility spiked, the response was to print money and paper over whatever problems were ailing the world so as not to admit no one knows what the fuck is going to happen in the future.

Just like when you hold an inflated ball underwater, the deeper you push the ball, the more energy is required to maintain its position. The distortions are so extreme globally, especially for Pax Americana, that the amount of printed money required to maintain the status quo grows exponentially each year. That is why I can say with confidence that the amount of printed money from now until the eventual system reset will dwarf the total amount that has been printed from 1971 to date. It’s just maths and physics.

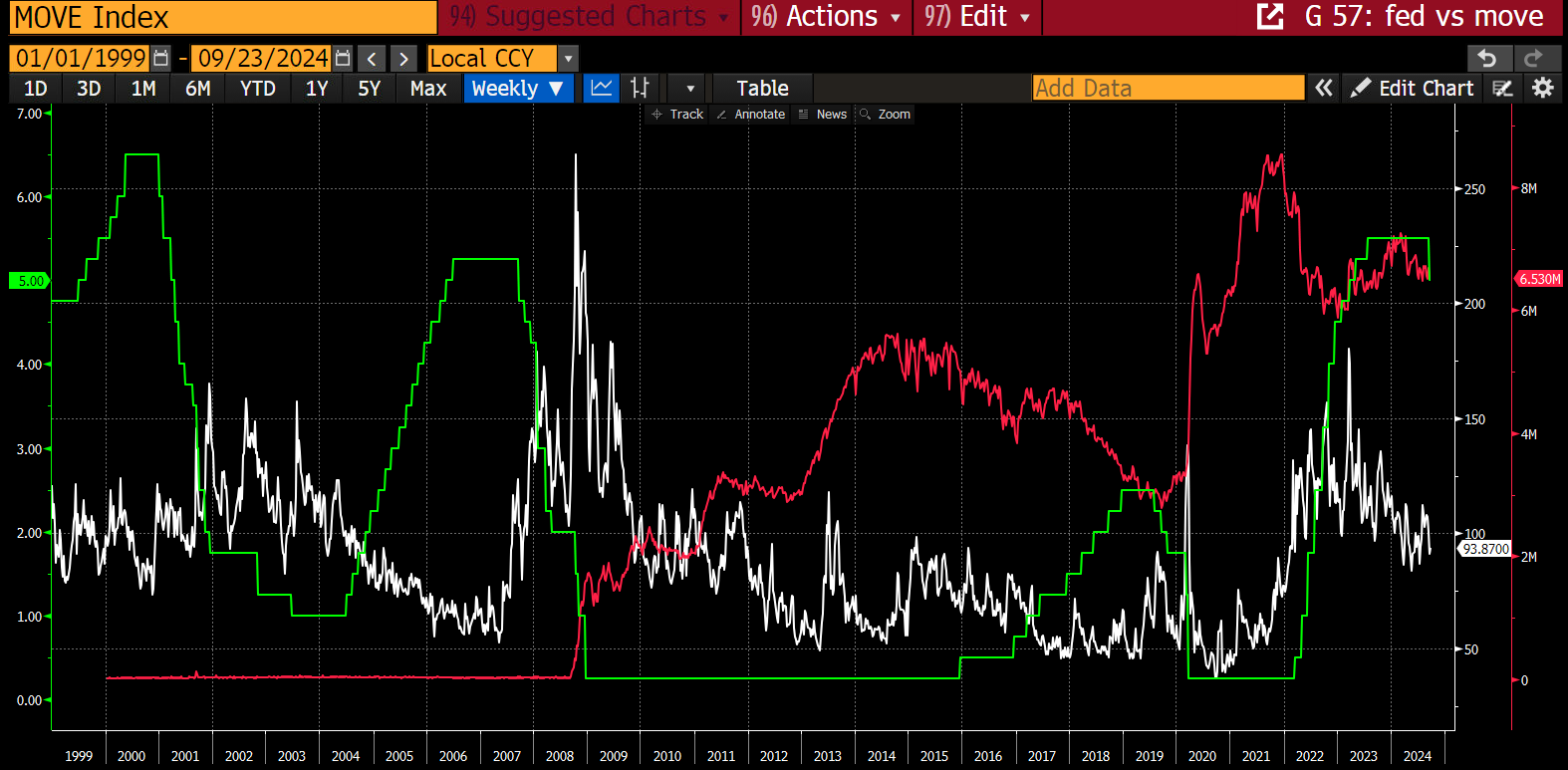

The first chart I’m going to show you is of the MOVE Index (white), which measures US bond market volatility against the Fed Funds upper bound rate (green). As you know, I believe quantity is more important than price, but using price in this case paints an extremely clear picture.

Some of y’all remember the run-up and collapse of the 2000 tech bubble. As you can see, the Fed popped the bubble by increasing rates until something broke. The volatility of the bond market spiked in 2000 and again in 2001 after the 9/11 attacks. As soon as volatility spiked, the Fed cut rates. Volatility fell, and the Fed felt it could normalise rates, and then boom, they popped the subprime housing market, which precipitated the 2008 Global Financial Crisis (GFC). Rates were quickly taken to zero for almost 7 years to smother volatility. Again it was time to normalise rates, and then COVID happened, which caused a bond market meltdown and spike in volatility. The Fed cut rates to zero in response. COVID-stimulus inspired inflation set the bond market on fire starting in 2021, which increased volatility. The Fed raised rates in order to slay inflation, but had to stop around the time of the March 2023 non-TBTF banking crisis. Finally, the current Fed easing cycle occurs at a time of heightened bond market volatility. If you consider the 2008 to 2020 era as “normal”, the current bond market volatility is close to double our master’s comfort level.

Let’s add in a proxy for the quantity of dollars. The red line is an approximation of the total stock of bank credit. It is a combination of excess banking reserves held at the Fed and other deposits and liabilities (ODL), which is a good proxy for commercial banking loan growth. Remember from economics 101, it is the banking system that creates money via issuing credit. Excess reserves grow as the Fed conducts QE, and ODL grows as banks issue more loans.

As you can see, 2008 was a watershed moment. The financial crisis was so large that a geyser of credit-based money gushed at such a scale as to obscure what happened in the post-2000 tech bubble collapse. It is no wonder that our Lord and Savoir Satoshi created Bitcoin in 2009. Ever since, the gross level of bank credit has never been fully drawn down. This fiat credit cannot be extinguished, otherwise the system would collapse under its own weight. Additionally, in every crisis, the banks must create an ever greater amount of credit to smother volatility.

I could present a similar chart for foreign exchange volatility of the USDCNY, USDJPY, EURJPY etc. against government debt levels, central bank balance sheets, and bank credit growth. They are not as clean as the one I just showed you. Pax Americana cares about bond market volatility as it is the asset underpinning the global reserve currency, the US dollar. All other allies, vassals, and enemies focus on the volatility of their domestic currency vs. the dollar as it impacts their ability to trade with the world.

The Reaction

All this fiat wampum must go somewhere. Bitcoin and crypto are the release valves. The fiat required to keep volatility at suppressed levels will find its way into crypto. Assuming the technical soundness of the Bitcoin blockchain, Bitcoin will always benefit as the elites continue attempting to violate the law of physics. There must be a balancer; you can’t get something out of nothing. For every action, there is a reaction. Bitcoin just happens to be the most technically sound way in this modern digital world to balance the profligacy of the ruling elite.

As an investor, trader, and speculator your goal is to acquire Bitcoin at the cheapest cost possible. Maybe that means pricing your hourly labour in Bitcoin, diverting excess cheap energy into Bitcoin mining, borrowing fiat at low rates and purchasing Bitcoin (paging Michael Saylor), or buying Bitcoin with some of your fiat savings. The volatility of Bitcoin vs. fiat is your asset, don’t squander it by employing leverage to buy Bitcoin that is to be held for long periods of time.

Are there any risks?

Speculating profitably on short-term price movements is hard. As you can see from my record, I’m 2 for 6. If I was swinging my entire portfolio long and short every time I made a call, Maelstrom would be bankrupt by now. Randall and Kyle Davies got it right; there is a super cycle in terms of volatility suppression by the elites. Instead of being patient, they borrowed fiat to buy more Bitcoin and as the cost of funds changed for fiat, which it always does, they got caught out and lost everything. Well, not everything – I saw photos of Randall hosting a lavish party at his Singapore mansion. Don’t worry, though – it’s in his kids name so as to avoid seizure by the bankruptcy courts.

Assuming you don’t misuse fiat leverage, the real risk is when the elites can no longer suppress volatility, and it surges to its natural level. At that point, the system resets. Will it be a revolution like in Bolshevik Russia, where bourgeois asset holders got wiped out entirely, or like the more common varieties where one group of corrupt elites is replaced by another and the misery of the masses continues under a new “ism?” In any case, everything goes down, and Bitcoin just falls less vs. the ultimate asset … energy. You are still outperforming, even though your overall wealth is diminished. Sorry, there ain’t nothing in the universe that is risk-free. Safety is an illusion peddled by charlatans pining for your vote on election day.

Trading Tactics

The US

Judging by the Fed’s historical response to “elevated” volatility, we know once they start cutting, they usually don’t stop until rates are near 0%. In addition, we know that bank credit growth must accelerate alongside the rate cuts. I don’t care how “strong” the economy is, how low the unemployment rate goes, or how high inflation gets, the Fed will continue cutting, and the banking system will emit more dollars. The government will also continue borrowing as much as it can to engender the support of the plebes from now until the foreseeable future, regardless of who wins the US Presidential election.

The EU

The EU unelected bureaucrats are committing economic suicide by shunning cheap and plentiful Russian energy, and dismantling their energy production capacity in the name of “climate change,” “global warming,” “ESG,” or whatever other nonsense slogan they trot out to their populace. The economic malaise will be treated with lower euro interest rates set by the European Central Bank. And national governments will begin to force banks to issue more loans to local companies so they can provide jobs and rebuild crumbling infrastructure.

China

As the Fed cuts rates and US banks issue more credit, the dollar will weaken. This allows the Chinese government to ramp up credit growth while keeping a stable dollar-yuan exchange rate. Chinese President Xi Jinping’s major fear about accelerating bank credit growth is pressure on the yuan to depreciate vs. the dollar. If the Fed prints, the People’s Bank of China (PBOC) can print as well. This week the PBOC unveiled a raft of interest rate cuts across the Chinese monetary system. This is just the start; the real bazooka will come when Xi instructs banks to issue more credit.

Japan

If the rest of the major economies are now easing monetary conditions, there is less pressure on the BOJ to raise rates quickly. BOJ governor Ueda has emphatically said that he will normalise rates. But he doesn’t have to play catch-up as quickly, given that everyone else is coming down to his level of low interest rates.

The moral of the story is that the global elites are once again suppressing volatility in their country or economic bloc by lowering the price of money and boosting its quantity. If you are fully invested in crypto, sit back, relax, and watch the fiat value of your portfolio pump. If you have extra filthy fiat, left curve this bitch and deploy into crypto. As far as Maelstrom is concerned, we will be pushing our projects that held off on launching their token due to poor market conditions to hurry the fuck up. We want to see those green doji’s in our Christmas stockings. And the boys at the fund want a good 2024 bonus, so please help them out!

Want More? Follow the Author on Instagram and X