Diesen Inhalt auf deutsch übersetzen und umschreiben. Die Länge des Beitrags beibehalten. Unterteile den Beitrag in mehrere Absätze mit h2 und h3 Zwischenüberschriften. Beachte den SEO Aspekt und schreibe h2 und h3 Überschriften..

If you’re anything like the rest of us, you’re looking for ways to increase your profits in bullish markets. In this article, we’ll share how crypto options can help you outperform in a bull market as well as better manage risk.

We’ll share 3 scenarios where you can strategically use options to capitalise on an asset’s bullish momentum – using Bitcoin as an example. We’ll share detailed set ups for you to…

- Buy the dip with precision

- Bet on big price targets

- Profit from range-bound trading

Let’s dive in.

Scenario 1: Buy the Dip With Put Options

If you’re bullish on Bitcoin in the long term, you’re probably looking to buy every dip. But that’s easier said than done — traditional methods like setting limit orders, aren’t so perfect. Imagine watching your buy order miss by a mere $0.01, only to see Bitcoin rally shortly after—an experience we’re sure many of you can relate to.

Strategy 1: Sell Put Options

One way to improve your dip-buying strategy is by selling put options at a specific strike price below the current market level.

Why is this approach smarter than waiting for a price drop?

Why is this approach smarter than waiting for a price drop?

- Earn a Premium: When you sell a put, you collect a premium (an upfront payment) that provides a guaranteed return if Bitcoin’s price doesn’t reach the strike level before expiration.

- Set a Target Price: If Bitcoin’s price falls to or below your chosen strike price, you may be obligated to buy the asset at that level, effectively executing the “buy the dip” strategy with added profit from the premium.

- Downside Protection via Premium: The premium received provides some buffer to potential losses, making this a lower-risk strategy compared to outright spot buying.

Example Set Up

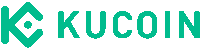

Let’s say Bitcoin is currently trading at $75k. You sell a put option with a strike price of $72k, expiring on 15 Nov.

If Bitcoin reaches below $72k by the expiry date, your put option will be exercised on the expiry date. This means you’re effectively obligated to buy Bitcoin at a $72k strike price.

If Bitcoin does not go below $72k on expiry, you would collect a nice premium of $1,432 despite not having bought any Bitcoin.

Strategy 2: Use a Risk Reversal

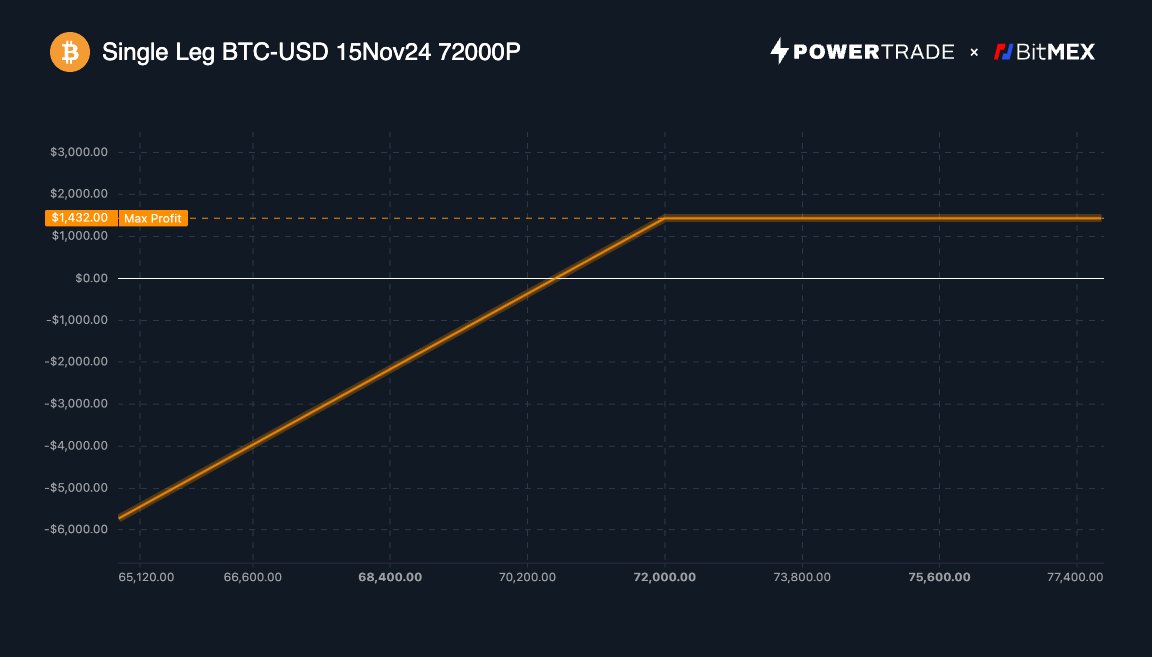

If you’re comfortable taking on more risk for potential gains, consider a risk reversal strategy, which combines selling a put with buying a call at a higher strike price.

Why is this approach smart?

- Downside Buffer: Selling a put allows you to generate premium income that can help cushion slight price drops.

- Upside Participation: The premium received from the put can offset the cost of buying a call option, allowing you to participate in upward moves without additional cost.

- Balanced Risk-Reward: This approach provides an entry point at your desired price while giving you exposure to price gains, making it ideal if you anticipate a slight dip followed by a rally.

With risk reversals, you can align yourself to gain from both market pullbacks and bullish momentum – making it a smart choice in a volatile bull market.

Scenario 2: Bet on Big Price Targets With OTM Call Options

Let’s say you’re convinced that Bitcoin could hit a dramatic price pump milestone within the next few months (e.g. $100k by December 2024).

Strategy: Use OTM Calls

While an outright spot purchase at this level is risky and capital-intensive, out-of-the-money (OTM) call options offer an attractive alternative for betting on significant price moves.

Why is this approach smart?

- Low-Cost Entry: OTM calls have a strike price above the current market level, so they are less expensive than at-the-money (ATM) calls or spot purchases. This means you can gain exposure to large upside potential at a fraction of the cost.

- Defined Risk: The maximum loss in this strategy is limited to the premium paid, which is ideal for traders who want to cap their downside.

- Asymmetrical Reward: The further Bitcoin rises past the strike price, the more profitable the option becomes, giving OTM calls high leverage on upward momentum.

Example Set Up

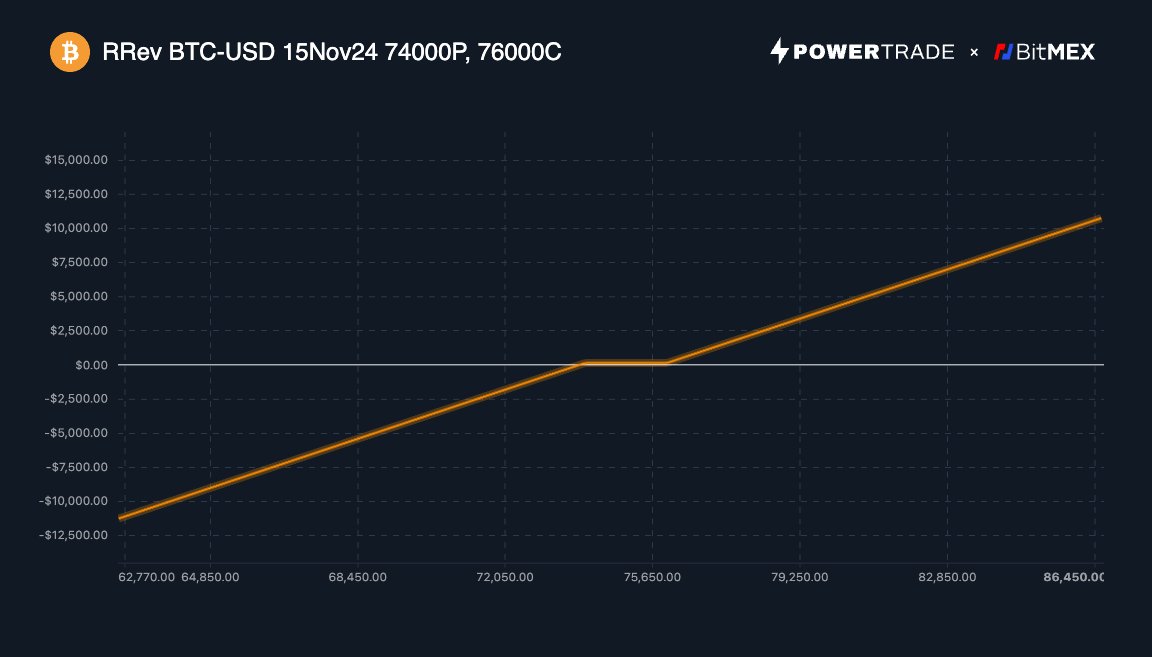

Let’s say Bitcoin is currently trading at $75k. You purchase an OTM call with a strike price of $90k, expiring in December.

If Bitcoin reaches $100k by the expiry date, the call option provides significant upside. If Bitcoin fails to reach the target, your loss is limited to the premium paid for the option.

In a bull market, OTM calls are a smart way to capture large market moves, especially when probability assessments suggest a reasonable chance of achieving high prices. Plus, this approach leverages the asymmetric payoff structure that options uniquely offer.

Scenario 3: Profit From Range-Bound Trading

Bull markets aren’t always straight upward trajectories; often, there will be periods of corrections and consolidation. In such times, swing trading is the way to go, and vertical spreads can be a powerful options trading strategy.

Strategy: Use Vertical Spreads

A vertical spread involves buying and selling call or put options at different strike prices within the same expiration. This setup is particularly useful when you expect Bitcoin to trade within a certain range.

Why is this approach smart?

- Reduced Cost and Risk: Vertical spreads require less capital than buying a single option outright. For instance, a bull call spread (buying a lower strike call and selling a higher strike call) provides bullish exposure with capped risk and a lower premium.

- Profit from Range-Bound Movement: In a range market, where Bitcoin is expected to swing between defined levels, vertical spreads help you capture gains without the need for precise timing or excessive risk.

- Predictable Risk-Reward Ratio: Since the maximum profit and loss are defined upfront, traders can take calculated bets based on the expected price range.

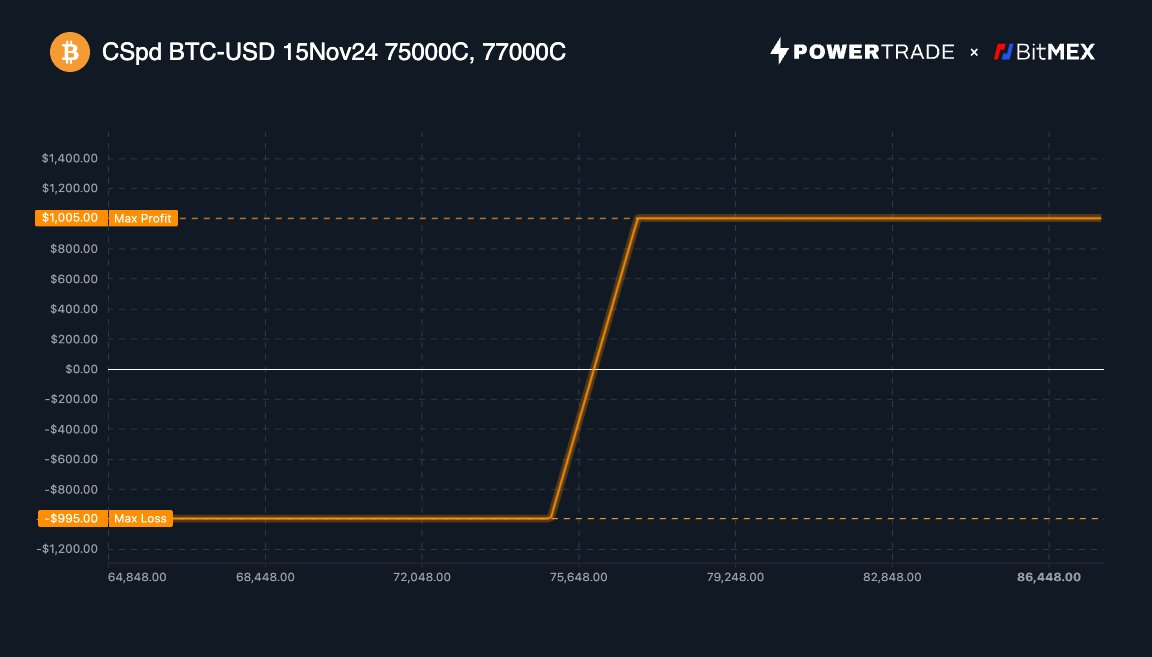

Example Set Up

Suppose Bitcoin is trading around $75k, and you expect it to go up to the range between $77k to $78k.

A bull call spread could involve buying a call at a $76k strike price and selling a call at a $78k strike.

In the event that Bitcoin does go up, the spread allows you to profit from the differential in strike prices without risking as much as a full position.

Vertical spreads are well-suited to a consolidating bull market because they enable traders to manage risk and reward ratios with precision, making them an ideal fit for range-bound trading.

The Bottom Line: Options as a Strategic Advantage in a Bull Market

Crypto options are a great way for traders to navigate bull markets effectively, especially in three particular scenarios:

- Buying the Dip: Selling put options or using risk reversals enables traders to profit from pullbacks or secure entry points.

- Capturing Big Moves: OTM call options are ideal for those with high conviction in large price moves, offering significant upside with limited downside.

- Swing Trading: Vertical spreads offer a cost-effective way to trade within expected price bands, mitigating risk in a ranging market.

Each of these strategies can help traders refine their approach to the bull market, maximising gains while managing risks. As you consider your next move in the crypto market, options trading may be the edge you need to ride the waves with confidence.

Theoreticals aside, if you wish to begin trading crypto derivatives or spot on BitMEX, you can find all our existing products here. For more educational resources on trading at BitMEX, particularly derivatives, visit this page.

To be the first to know about our new listings, product launches, giveaways and more, we invite you to join one of our online communities and connect with other traders. For the absolute latest, you can also follow us on Twitter, or read our blog and site announcements.